The Benefits of Financial Planning Across Life Stages

Financial planning is an essential tool for navigating life’s complexities, providing stability and a pathway to achieving personal and financial goals. At every stage of life, financial priorities and challenges evolve, making it crucial to adapt your financial strategies accordingly. Below, we explore the benefits of financial planning tailored to each significant life stage, ensuring […]

Unlock Your Financial Potential

Understanding and Transforming Your Money Mindset At Tanti Financial Services, we believe that financial success isn’t just about numbers—it’s also about your mindset. Your attitudes and beliefs about money can significantly impact your financial decisions and, ultimately, your financial well-being. Let’s explore the concept of money mindset and how understanding it can help you achieve […]

Taking Care Of Business

Owning a business has its distinct advantages. Choosing your work hours and being able to make decisions for your own future are just two, but this higher level of freedom takes a back seat when things go wrong… and as any business owner knows, things can and do go wrong just like in any other […]

Fortify your Finances – A Recession Survival Guide

In the ever-fluctuating world of economics, recessions are an inevitable part of the financial cycle. While they can be daunting, understanding their nature and preparing for their impact can make a significant difference in weathering the storm. Understanding Recessions At its core, a recession represents a period where economic activity contracts, often reflected in consecutive […]

The Impact Of Interest Rates On Managing Debt

Credit cards, personal loans, and mortgages. While it can be easy to pick up debt as you go through life, changing interest rates, workplace interruptions and other life changes, can make it much, much harder to repay that debt. A few simple tips can make the task a lot easier. Taking Stock of Your Debts […]

Financial Education for a Successful Future

Think back to when you got your first job and that sweet taste of financial independence. Regardless of what age you started working, it’s unlikely you knew how to manage that first paycheck. Let’s face it, our world isn’t particularly adept at teaching financial literacy to the younger generation. I don’t know about you, but […]

Why Millennials Should Be Thinking About Their Retirement Today

While millennials have for decades been treated like ‘the children of Neverland, who never grew up’, reality is fast catching up with this generation, who are now young adults between the ages of 24 and 40. Like generations before them, they are now buying, or at least trying to buy, homes and starting families of […]

Is FIRE For You?

FIRE… Financial Independence, Retire Early. Sounds nice, doesn’t it? It’s easy to see why the FIRE movement is burning hot across the younger generations. The notions of financial independence and early retirement are surely appealing to the majority. But as with most good things, it comes at a price, and it’s important to weigh up […]

What Drives Young Investors To Property?

Recent research by CommBank (April 2021) has shown that almost half (45 per cent) of millennials consider property investment the most appealing investment option, followed by the stock market at 38 per cent. These figures will likely come as no surprise, given Australians’ love for property ownership (“Great Australian Dream” anyone?), but what drives young […]

Why Financial Success Isn’t Just A Numbers Game!

Money, finances, investments… it is easy to see why, logically, financial success could be considered a numbers game. However, real financial success requires much more than just numbers that work. It also requires passion, interest, determination, commitment, perseverance, optimism, resilience and more. This is why mindset is such a critical ingredient to the financial success […]

Foundations Of A Wealthy Lifestyle

A study conducted by the Australian Stock Exchange reported that nearly 25% of investors over the past two years were aged 18 to 24. These young Australians were found to be knowledge seekers, keen to take on life and begin their journey towards financial security. If this describes you, congratulations! You get it, you really […]

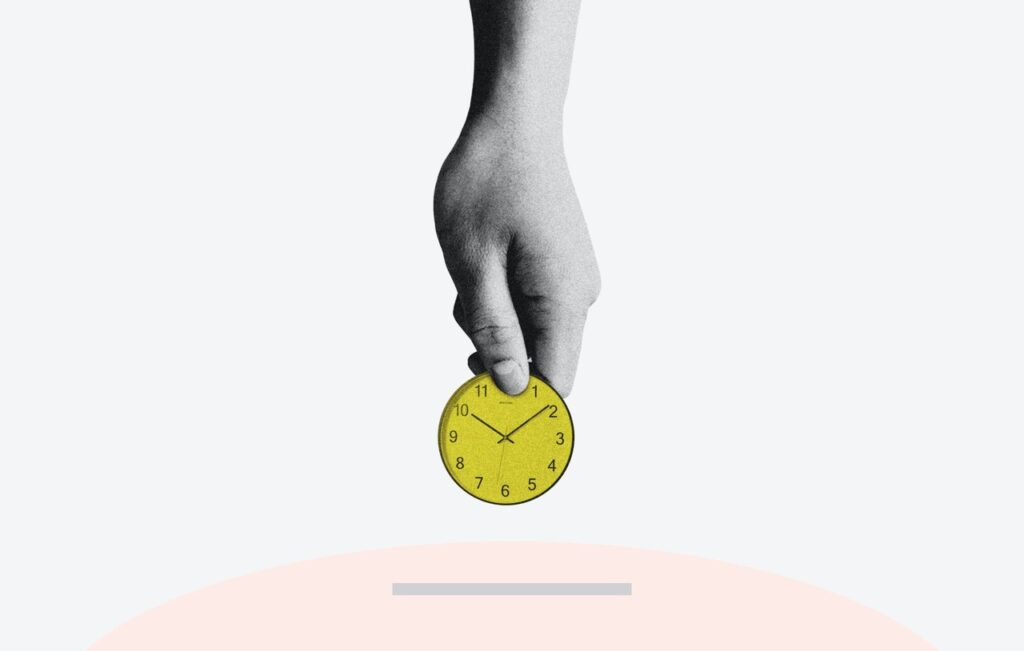

Tap Into The Amazing Power Of Compounding

When you invest over a period of time, compound interest is your best friend. In effect, it means you are earning interest not just on your own capital, but also on the interest you’ve already earned. Over the long term, this might be phrased as “interest on interest on interest on interest on interest …” […]

Hidden Costs Of Buying A New Home

You’ve decided that it’s time to buy your first home; Congratulations! It’s such an exciting milestone in anyone’s life and should be as effortless as possible. It’s important not to be caught out by the hidden costs that come with the purchase of your home. The costs add up quickly and can cause issues if […]

6 Steps To A Happy New Financial Year

The new financial year provides an opportunity for a fresh start for your finances. Make this the financial year you get on top of yours… for good! We’ve broken it down into six bite-sized, manageable steps for you to tackle over six months, because real change takes time! The below is a suggested path to […]

8 Tips To Save Money On Your Bills

We work hard to earn our income and even harder to save it to achieve our dreams. Even a few dollars saved on different types of bills over the years can compound to something meaningful. Let’s go through some of the ways that can help achieve these savings. Track your expenses Why should you track […]

4 Fool-Proof Ways To Keep On Top Of Your Credit Card

Credit cards certainly make life easier – they are simple to use, accepted almost everywhere, and help you to buy what you want, when you want, particularly online. So much so that living close to the credit limit has become the norm for many people and spending can quickly get out of hand. To make […]

Is Your Inner Entrepreneur Calling?

Work From Home (WFH) arrangements seem to have got our creative juices flowing with more online, home-based businesses springing up every day, providing a limitless variety of goods and services. Home based micro businesses (0 – 4 employees) and small businesses (5 – 19 employees) offer everything from retail items, to construction industry services. According […]

What Does It Take To Become A Millionaire?

Pssst! Want to be a millionaire? It may seem an impossible dream, but depending on your circumstances joining the ranks of the millionaires may be easier than you think. There are three key components to a successful savings strategy. The first is some surplus cash; an amount of money you can regularly set aside in […]

Are You A Financially Compatible Couple?

According to the Australian Bureau of Statistics (ABS), in 2019 there were 113,815 marriages. Sadly, in the same year there were 2,162 divorces, with financial issues cited as one of the major reasons for marriage breakdown. For couples deciding to move in together, the idea of buying a home and building a future can be […]

How Much Should I Have In My Emergency Fund?

When times are tough financially or unexpected bills pop up, having an emergency fund set aside can alleviate stress. Unfortunately, many people choose not to or struggle to find spare cash to put aside. It’s the most common story financial professionals hear. Unfortunately, too many people fail to set aside emergency savings to see them […]